In this section, you will be introduced to the corporate tax in Singapore. The corporate tax system is applicable to all companies. This system is not applicable for Sole Proprietorship and all forms of Partnerships.

Corporate Tax in Singapore

The headline corporate tax rate in Singapore is 17%. This rate is considered one of the lowest in economically advanced countries in the world. Headline rate refers to the highest tax rate in a particular jurisdiction. For most startups and SMEs, the effective tax you pay is often much lower than the headline rate of 17% after accounting for rebates, exemptions, deductions, and allowances.

Singapore currently adopts a one-tier corporate tax system. Under the one-tier corporate tax system, the tax paid by a company on its chargeable income is the final tax. All dividends paid by a company are exempt from tax in the hands of the shareholders.

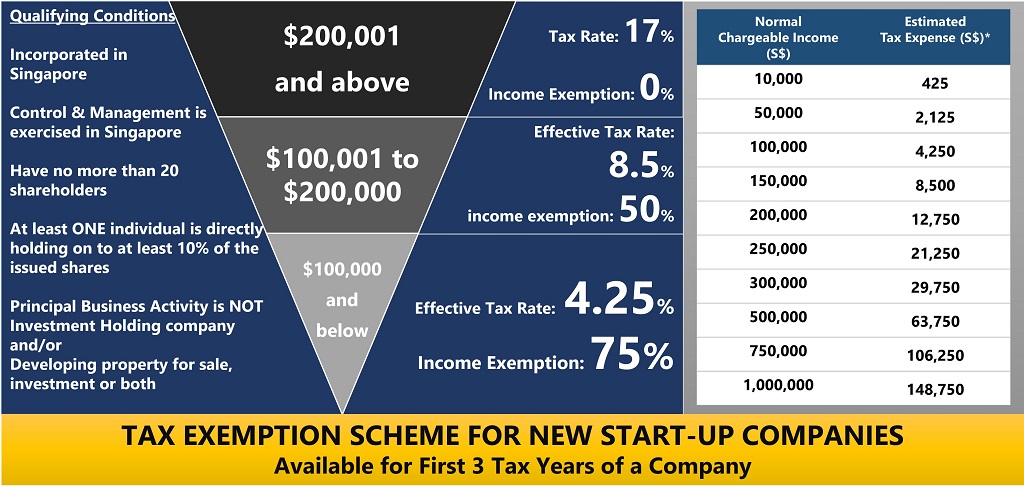

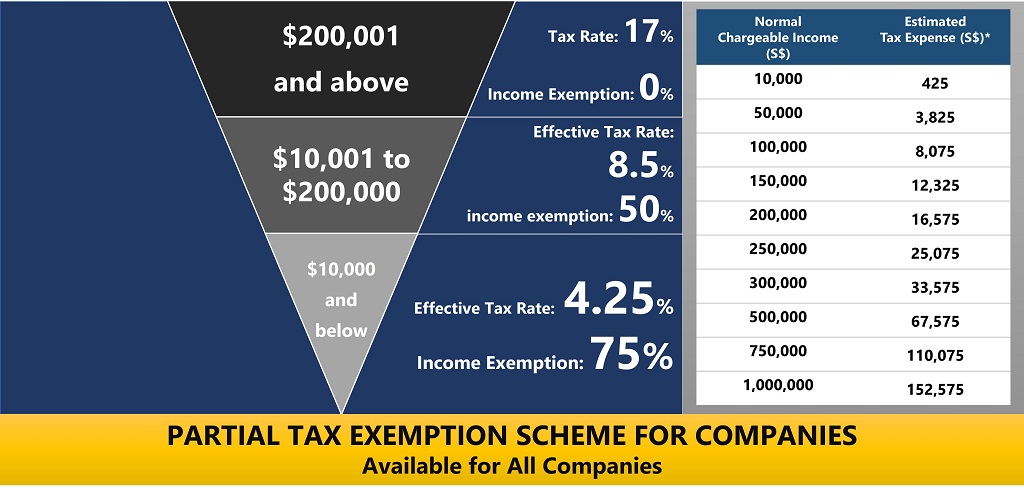

The corporate tax system can be split into 3 brackets if we take into consideration the exemption schemes granted by the tax authority.

For startup companies, the key exemption scheme granted to qualifying companies is the Tax Exemption Scheme for New Start-Up Companies, which is available for the first 3 tax years of the company.

The Partial Exemption Scheme will be granted for all companies that do not qualify for the Tax Exemption Scheme for New Start-Up Companies as well as companies into their fourth tax year.

Corporate Tax Rebate

There are currently no Tax Rebates announced for Corporate Tax Payers.

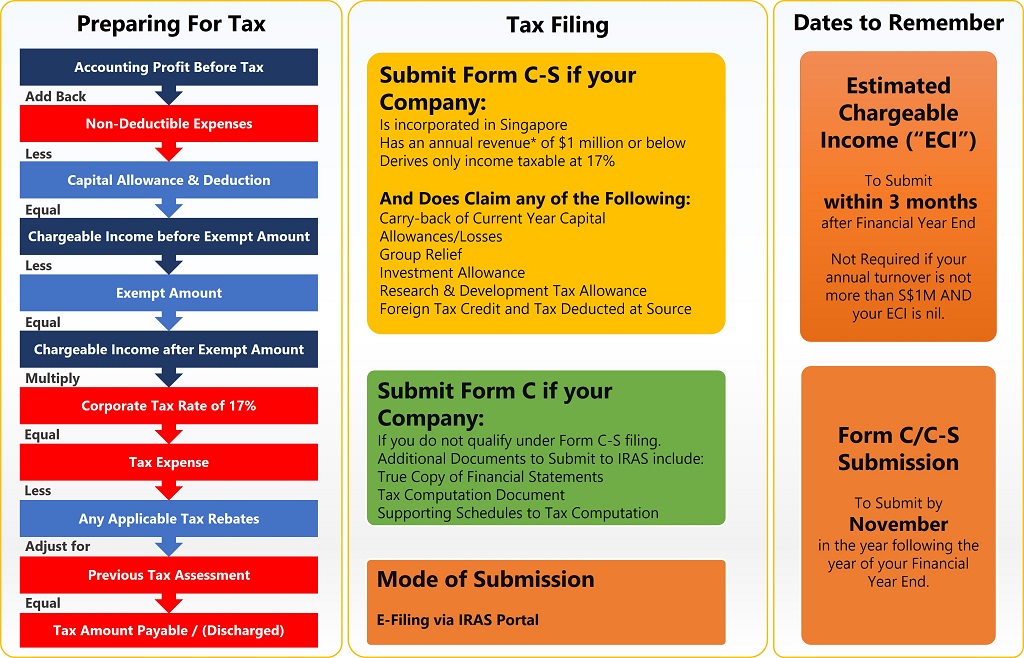

Corporate Tax Process for Small Businesses at a Glance

The following illustrates a standard routine for companies preparing for corporate tax submission.

Typically, the preparation of tax is done by a tax agent who will prepare and oversee the entire tax filing process for the year of assessment he or she is engaged for.

Appointing a Tax Agent for your Company

In the event that you wish to appoint a tax agent to handle the tax matters on behalf of your company, you will need to authorize the assigned company providing the tax services as an authorized filer of your company taxes. You can only perform this authorization by appointing us as a Tax Agent using your CorpPass.

A director of the company who has admin rights for the company CorpPass account can log in with his or her SingPass account to access the CorpPass Portal and authorize us as the Tax Agent.

Learn more about what is taxable income, deductible and non-deductible expenses, capital allowances, and deductions in the next few articles in our Corporate Tax Resource section.

ContactOne is able to help you with your Bookkeeping, Financial Statements, and Tax matters.

- Let us perform a preliminary assessment on the state of your company accounts and we will advise you accordingly on the best way to manage your accounts as you continue to grow your business.