A CRASH COURSE ON RECORD KEEPING for SMALL BUSINESS OWNERS

In this article, you will gain a basic understanding of what are the starting steps to maintaining transactional records for small businesses. This article is suitable for first time business owners who have no experience on how to get their record keeping going.

Ingredients of Small Business Record Keeping for Pte Ltd Companies

- Monthly Bank Statements

- Sales Invoices / Records

- Credit Note Records

- Purchase Receipts and Documentation

- Stock or Inventory Records

- Payroll Records

- CPF Records

- Fixed Assets Records

- Rental Agreement and Payment Records

- Bank Loan Agreement / Hire Purchase Agreement with their schedule of repayments and interest table

- Receipts and Documentation of Expenditure incurred by Directors or Business Owners on behalf of the Company (expenses out of your own pocket)

- A suitable accounting recording system (You may invest in an accounting software or simply use Excel if your business is small and simple enough)

- A set of Self Inking Stamps that include Paid, Received and Posted.

Important Note on Source Records for a Company

Under the Income Tax Act, a Company is required to keep proper business records for a minimum period of 5 years.

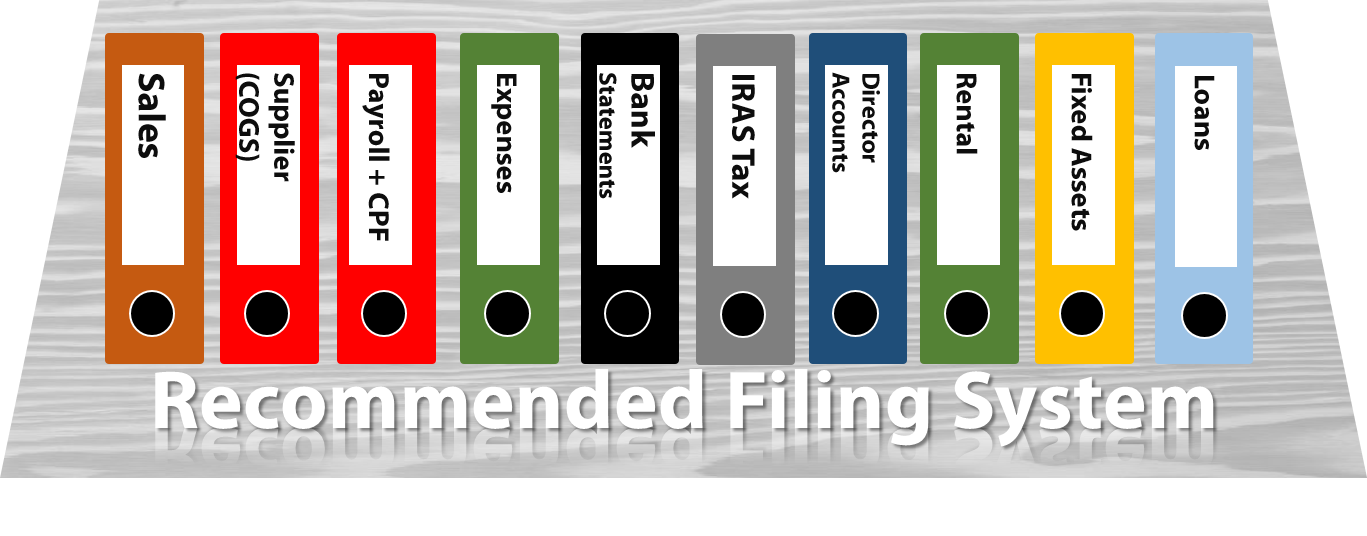

This is a fairly simple rule to follow if you are able to keep a good filing system for all your business records. For a start, be very generous with the number of files you create for your company records. From our experience, we noticed that businesses like to file everything in one or two files with no proper segregation of document types. We recommend that a separate file be created to keep track of specific transactions for ease of retrieval and tracking. You may refer to our illustration for a sample category of files to create for your business.

| ACCOUNTING FILE | DESCRIPTION |

| SALES FILE | Houses all your sales invoices with a section for Credit Note (if any) |

| SUPPLIER (COGS) FILE | Houses all supplier invoices. The difference between this file and the Expense file is that this file contains expenses incurred for goods, services or materials that you will use for your business sales whilst the expense file will contain all other administrative and operating expenses |

| PAYROLL + CPF FILE | Keeps all payroll records, CPF and Foreign Worker Levy transactions here |

| EXPENSE FILE | Contains all other administrative and operating expenses (example: Utilities, Telecommunication, Printing & Stationery etc. You may opt to categorize the expenses by Date (recommended) or by Type of Expenses.

If a certain type of expense is high in volume, example if a company has numerous transport claims, it is recommended that you maintain a separate expense file for that particular expense. |

| BANK STATEMENTS FILE | Contains all Monthly Bank Statements for your Company. This is one of the most important files in your record keeping |

| IRAS TAX FILE | Contains all IRAS letters, notice of assessments and correspondences |

| DIRECTOR ACCOUNTS FILE | Contains all transactions paid on behalf of the Company, by the Directors of the Company, and yet to be reimbursed by the Company. You may consider creating this file if there is a significant volume of transactions that are paid by the Directors initially. With this file, it will be more efficient for the person preparing the accounts to identify transactions not paid through the Company account, and also facilitates Reimbursement. |

| RENTAL FILE | You may create this file to keep track of rental expenses. If you only lease one office with no variable charges, you may keep rental invoices in the Expense file. |

| FIXED ASSETS FILE | Contains all invoices relating to acquisition of Fixed Assets like Computers and Softwares, Office Equipment, Furniture and Motor Vehicles. This will allow you to account for taxes and make relevant claims and allowances for Fixed Assets when it�s time to file your company taxes. |

| LOANS FILE | Contains all Bank Loan agreements, Hire Purchase Lease agreements, Third Party Loan agreements with the corresponding payment schedule and interest amortization table. |

Stamp Your Documents to Keep Track of Activity Progress

Why Stamp your Documents?

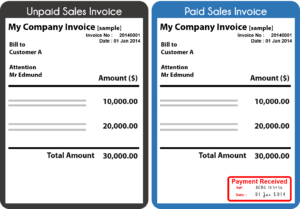

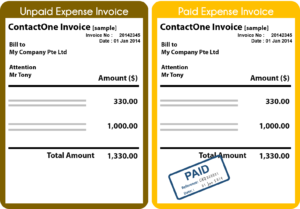

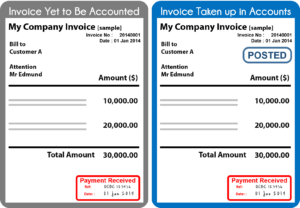

Stamping of your accounting records will give you a clear indication of the transactional status of a particular business activity when you look at that piece of invoice or receipt. It just takes about 10 seconds to stamp a document, write down the cheque reference and date of receipt. This additional 10 second per piece of document may save you from sleepless nights when you attempt to do up your books at the end of the year. Furthermore, this will allow business owners to have the ability to track receivables and payables based on the invoice information.

Imagine two scenario…

Scenario #1 – Start Bookkeeping with matching 500 receipt and invoice documents to your bank statements without any inkling of whether the transaction has been received, paid or cancelled.

Scenario #2 – Start Bookkeeping with matching 500 receipt and invoice documents to your bank statements with clear stamping of when and how the transaction has been received, paid or cancelled.

The 500 ten-second stamping activity that you spent over the last 12 months translates to roughly about less than 1.5 hours in aggregate. We doubt you will be able to sort out those mess in scenario #1 in less than 2 hours.

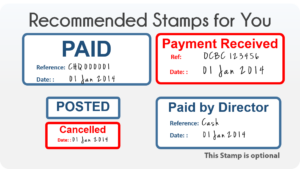

What Stamps Do I Need?

We recommend these:

It is highly recommended that you get self-inking stamps that have a Reference and Date Entry line for you to record the information. This is to remind you that you need to document the transaction reference and date of payment/receipt whenever you stamp your documents.

Examples of Document Stamping for Proper Record Keeping

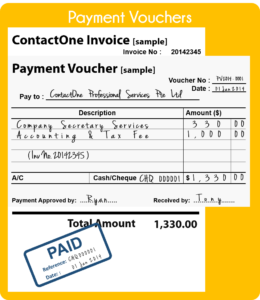

Payment Vouchers

Use Payment Vouchers to record expenditure in a standardized methods. Payment vouchers are principally used to ensure payments are duly approved by the correct authorized personnel before payments are disbursed.

For small business owners, with no particular payment authorization mandate in place for company expenses (example: a single owner-managed company), the payment voucher becomes an expense record document since the person issuing and authorizing is the same person.

You may consider using the payment voucher system to better manage and record the expenses your company has paid out.

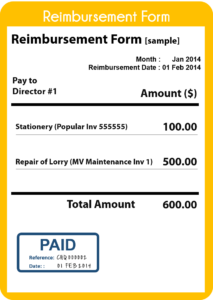

Reimbursement Form

Whenever you made payments on behalf of the Company, you will like to claim back the expenses paid on behalf of the Company. It is highly recommended that you have a reimbursement process within the Company to ensure all expenses are reimbursed on a timely basis. You can make use of a monthly reimbursement form to help you keep track of transactions that you will like to claim back from the Company.

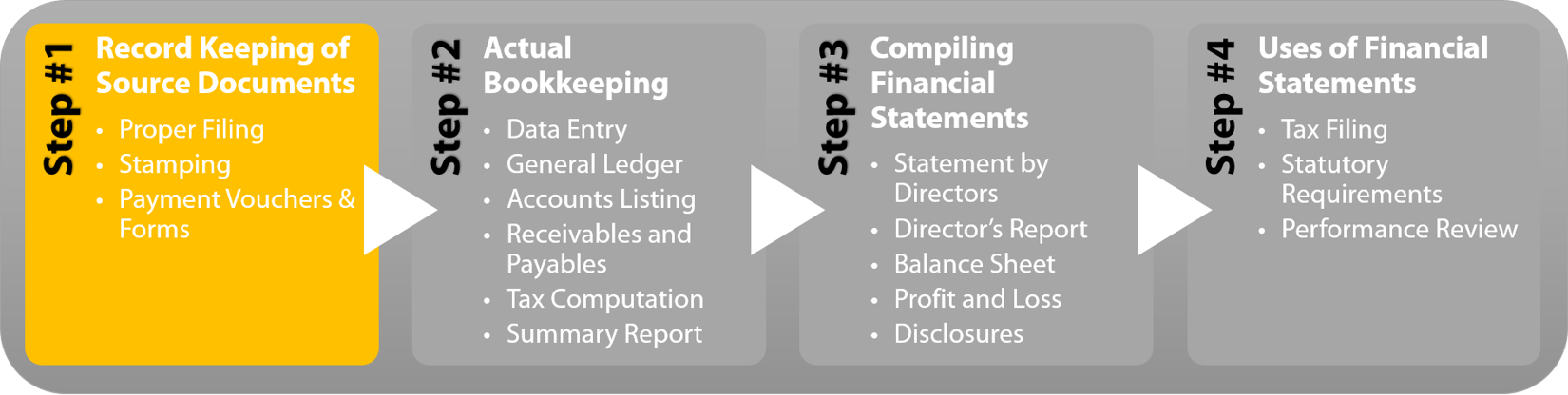

Translating Records into Accounting Information

The reason for keeping proper records of your company transactions is to facilitate a seamless process in the translation of these records into readable and useful accounting information for your Company. You will not have a clear indication of how your business is performing by flipping through all the source records we have covered above.

All the information that you have documented will have to be keyed into your bookkeeping system (or perhaps Excel workbook for very small businesses) to maintain a transactional listing of the records of your Company, which will be covered in the next section “Concept of Accounting“.