THE PRIVATE LIMITED COMPANY – PART II: INTRODUCTION TO COMPANY ANNUAL COMPLIANCE, TAX BENEFITS AND GENERAL REGULATORY RULINGS

In this section, you will learn about what are the key components and people of a Private Limited Company. You will appreciate and understand:

- The Annual Obligations for a Private Limited Company

- Tax Benefits applicable to Private Limited Companies

- Important Regulatory Rulings relating to sales tax (GST) and employee provident fund (CPF)

ANNUAL OBLIGATIONS FOR A PRIVATE LIMITED COMPANY

Compliance Overview

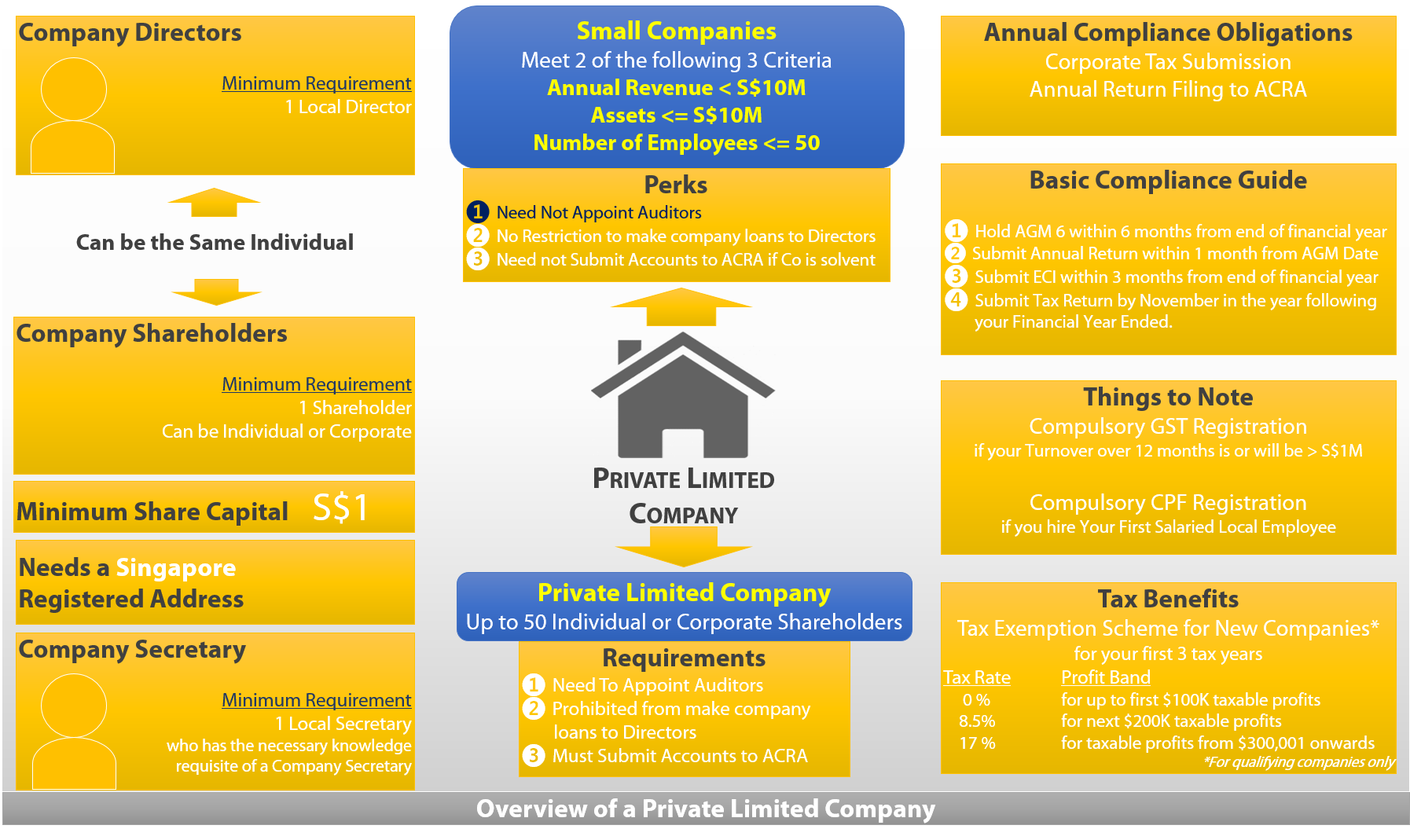

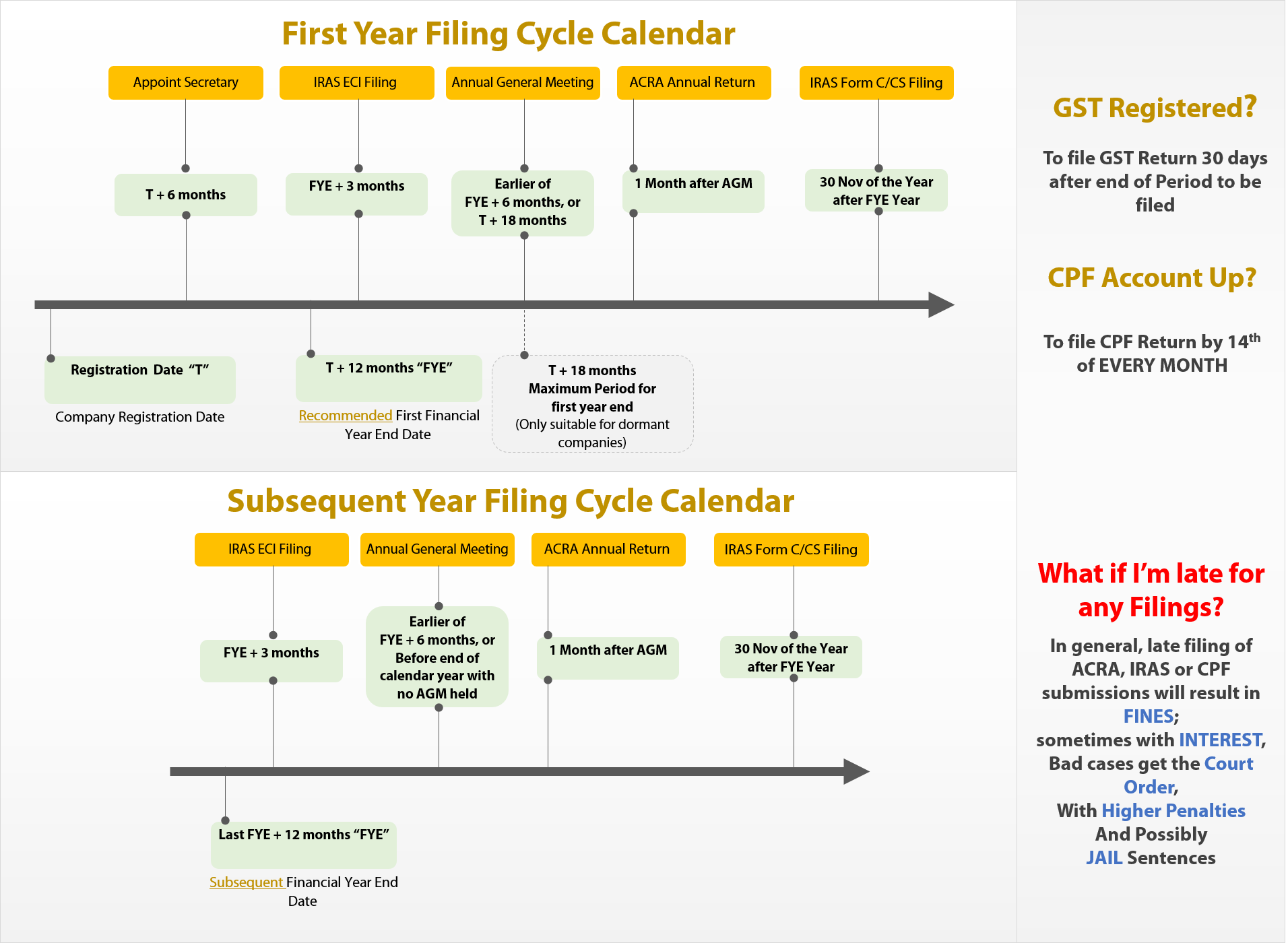

The illustration below depicts the standard compliance procedures for most companies in Singapore.

THE TWO BIG THINGS TO COMPLY WITH EVERY YEAR

A Private Limited Company needs to comply with 2 major compliance matters every year:

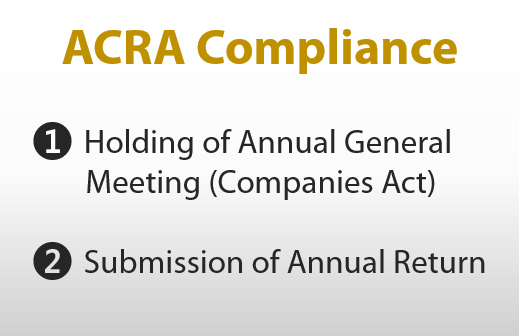

ACRA Compliance

Every company is required to hold an Annual General Meeting (AGM) and file for the Annual Return to the Registrar of Companies within one month from the AGM date. An AGM is simply the annual meeting of the shareholders of the Company. Typically, the appointed Company Secretary of the company will be involved in the drafting of the AGM documents necessary for the shareholders to approve and sign off.

The Annual Return filing requirements is dependent on the type of company, solvency status and whether the company is active or dormant for the financial year to be filed.

TYPE OF COMPANIES*

THE FOLLOWING WILL APPLY TO COMPANIES WITH FINANCIAL YEAR COMMENCING BEFORE 1 JULY 2015.)

For the purpose of filing Annual Returns, private companies are classified as

- Small Exempt Private Companies (EPC with revenue of $5M or less)

- Normal Exempt Private Companies (EPC with revenue in excess of $5M)

- Private Limited Companies (Non-Exempt)

THE FOLLOWING WILL APPLY TO COMPANIES WITH FINANCIAL YEAR COMMENCING ON OR AFTER 1 JULY 2015.)

For the purpose of filing Annual Returns, private companies that are exempt from Audit will be referred to as SMALL COMPANIES

A Small Company is one that can meet any TWO of the following THREE Qualifying Conditions (subject to Transitional provisions and Preceding Two Year Condition)

- Total annual revenue not exceeding S$10 million

- Total assets not exceeding S$10 million

- Number of employees of not more than 50

TRANSITIONAL PROVISIONS

An existing company can qualify as a “small company” if it is a private company and meets the quantitative criteria in the first or second FY commencing on or after the date of commencement of the “small company” criteria (1 July 2015).

FULL EFFECT AFTER TWO YEAR TRANSITION PERIOD

A Company is CLASSIFIED as a Small Company if it meets the Qualifying Conditions for both of the last 2 financial years and will remain as a Small Company until it is disqualified because it cannot meet the Qualifying Conditions for both of the last 2 financial years.

WHAT IS A SOLVENT COMPANY?

A company is considered solvent if it is able to meet its debts whey they fall due, otherwise, the company is considered insolvent (unable to meet its debts whey they fall due).

HOW DO I KNOW IF MY COMPANY IS ACTIVE OR DORMANT FOR THE PURPOSE OF ACRA FILING?

A company is considered dormant for a financial year if no accounting transaction occurs within the financial year. Notwithstanding the requirement to have no accounting transactions, the following activities can still be carried out by a company without affecting the dormant status of the company:

- The appointment of a company secretary

- The appointment of an auditor

- The maintenance of a registered office

- The keeping of registers and books

- The payment of fees to the Registrar or an amount of any fine or default penalty paid to the Registrar (ACRA)

- The taking of shares in the company by a subscriber to the memorandum in pursuance of an undertaking of his in the memorandum.

THE TABLES BELOW ILLUSTRATE THE EXTENT OF FILING REQUIRED FOR EACH TYPE OF COMPANY.

| Small Companies

Companies Exempt From Audit |

Audit of Company Accounts | File Accounts with ACRA | Declaration of Solvency |

| Active and Solvent | Not Required | Not Required | √ |

| Dormant and Solvent | Not Required | Not Required | √ |

| Active and Insolvent | Not Required | √ | Not Required |

| Dormant and Insolvent | Not Required | √ | Not Required |

| Private Limited Companies (Non-Exempt)

Companies NOT Exempt From Audit |

Audit of Company Accounts | File Accounts with ACRA | Declaration of Solvency |

| Active and Solvent | √ | √ | Not Required |

| Dormant and Solvent | Not Required | √ | Not Required |

| Active and Insolvent | √ | √ | Not Required |

| Dormant and Insolvent | Not Required | √ | Not Required |

IRAS Compliance

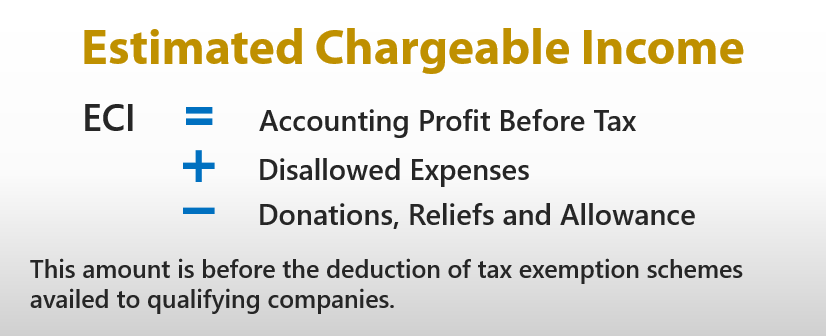

Every company is required to submit corporate tax filings to IRAS annually. There are 2 steps to the corporate tax filing process. The filling of the Estimated Chargeable Income (“ECI”) within 3 months from the end of your financial year, and the submission of tax Form C (together with your accounts and tax computation) or Form C-S in November in the calendar year following the financial year.

Estimated Chargeable Income

ECI is submitted for the purpose of paying advance taxes to IRAS. As an administrative concession granted by IRAS, a company need not submit ECI if:

- The annual revenue of the company is not more than S$1M in the financial year; and

- The Estimated Chargeable Income is 0.If your Company revenue exceeds S$1M, you will still need to file for ECI even if your ECI figure is 0.

SUBMISSION OF TAX FORM C / FORM C-S

The submission of corporate tax forms is due in November of the year following your financial year to be filed.

| Examples of When You Should Submit Your Tax Forms

Financial Year End of Companies |

Form C / Form C-S Filing Due Date | Year of Assessment |

| 31 December 2021 | 30 November 2022 | YA 2022 |

| 31 December 2022 | 30 November 2023 | YA 2023 |

| 31 March 2022 | 30 November 2023 | YA 2023 |

| 30 June 2023 | 30 November 2024 | YA 2024 |

TAX BENEFITS THAT A COMPANY ENJOYS

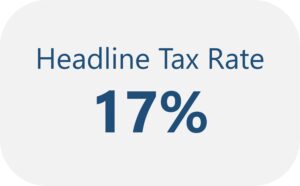

The most obvious benefit that a company enjoys from the tax perspective is the beneficial tax rates applicable for companies. The headline corporate tax rate for companies is 17%, which is one of the lowest in the Asia-Pacific region.

Headline tax rate refers to the basic rate of taxation, before taking into consideration applicable tax incentives.

This headline tax rate is 5% lower compared to the marginal personal tax rate (the highest tax bracket) of 22% under the Singapore personal tax system.

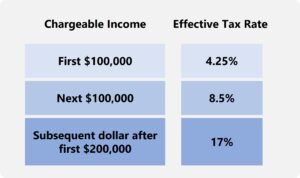

TAX EXEMPTION SCHEMES FOR NEW STARTUP COMPANIES

The Tax Exemption Scheme for New Startup Companies is applicable to qualifying companies for each of their first 3 tax years. This scheme allows for 75% exemption of tax for the first $100,000 normal chargeable income and 50% exemption for the next $100,000.

In order to qualify for the tax exemption scheme for new startup companies, the company must:

- Be incorporated in Singapore;

- Be a tax resident* in Singapore for that YA; and

- Has no more than 20 shareholders throughout the basis period for that YA; and

- In the event that there are corporate shareholders, at least 10% of the shares are directly held by an individual.

Please note that this scheme excludes investment holding companies and companies whose principal activity is that of developing properties for sale, for investment, or for both sale and investment.

*A company is a Tax resident in Singapore if the control and management is exercised in Singapore.

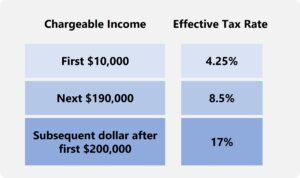

PARTIAL TAX EXEMPTION SCHEME FOR COMPANIES

For companies that do not qualify for the Tax Exemption Scheme for New Startup Companies, as well as companies that are into their 4th tax year, the Partial Tax Exemption Scheme for Companies will be applied.

Under this scheme, there will be a 75% exemption for the first $10,000 of normal chargeable income, followed by a 50% exemption on the next $190,000.

NOTE ON WHAT IS MEANT BY EXEMPTION

For example, when we say that there is a 75% exemption for the first $10,000 income, it simply means that the for the first $10,000 income, 75% x $10,000 = $7,500 of income will be exempted from tax. Tax will be levied on the remaining $2,500 at the 17% corporate tax rate. Likewise, if your company makes $5,000 income, 75% x $5,000 = $3,750 will be exempted, with corporate tax charged on the remaining $1,250 at 17%.

TAX REBATES

Tax rebates are granted to companies from time to time, usually in response to the general economic climate of Singapore at that period in time. There are currently no Tax Rebates announced for corporate tax payers.

In the past decade, in view of the prior periods of economic uncertainties and challenges faced by business owners, the Government made available corporate tax rebate (CIT) of 50%, capped at $25,000 for the Year of Assessment (YA) 2017 and CIT Rebate of 20%, capped at $10,000 for YA 2018.

The 50% (20%) Tax Rebate is simply a 50% (20%) “discount” on the final tax bill you will need to pay for the eligible year of assessment.

FIND OUT MORE ABOUT ALLOWANCES AND DEDUCTIONS INCLUDING PIC HERE.

FOREIGN TAX CREDITS

International double taxation results when the same income is being taxed twice: once at source where the income arises and another time when the income is received. An Agreement for the Avoidance of Double Taxation (“DTA”) may be signed on a bilateral basis to provide certainty on the taxing rights of each jurisdiction.

Singapore has entered into comprehensive double tax treaties with more than 70 nations worldwide. Key countries including Australia, China, France, Germany, India, Italy, Japan, Malaysia, Spain, Taiwan and the United Kingdom have entered into such comprehensive double tax treaties with Singapore.

Income sourced in DTA countries, received in Singapore

Double tax relief (“DTR”) will be provided to Singapore companies who are Singapore tax residents that incur taxes in countries that have signed a DTA with Singapore. A DTR is granted by allowing the Singapore tax resident to claim a tax credit for the amount of tax paid in the foreign country against the Singapore tax that is payable on the same income.

Income sourced in Non-DTA countries, received in Singapore

Unilateral tax credit (“UTC”) will be granted on all foreign-sourced income received in Singapore by Singapore tax residents from non-DTA countries with effect from YA2009.

REGULATORY REQUIREMENTS YOU MUST BE AWARE OF

GST Registration

The Goods and Services Tax (“GST”) is an indirect tax on the consumption of goods and services in Singapore. Your company, if GST registered, will act as the agent to collect these taxes from your customers on behalf of the Tax Authority.

You must apply for GST Registration if you expect your taxable supply for 12 months to exceed S$1M. You must also apply for GST Registration if your taxable supply has already exceeded S$1M and it is very likely that your taxable supply will also exceed S$1M for the next 12 months.

You may apply for GST Registration on a voluntary basis even if your taxable supply will not exceed S$1M. However, voluntary application will mean that you will need to be registered for a minimum of 2 years.

You will need to submit your GST Returns on a quarterly or half yearly basis. Your GST Return must be filed within one month from the end of the quarter or half-year that is due for filing.

Find out more in our GST Write-up HERE.

CPF Registration

Hiring your first local staff or intending to draw your first salary? Do note that CPF contribution is mandatory for all Singapore Citizens and Singapore Permanent Residents. Your company will need to apply for a CPF Account Number, as well as register for e-Submit to file for your monthly CPF submission. Typically, a GIRO account is set up and linked to your CPF Account.

CPF submission is a monthly obligation whereby you will need to make the filing by the 14th of each month for the salaries paid out in the previous month.

Find out more in our CPF Write-up HERE.

NEXT ARTICLE

Read more on How to Register a Private Limited Company in Singapore