A Brief Explanation of Accounting for SMALL BUSINESS OWNERS

In this article, you will gain a basic understanding of what are the general concepts of bookkeeping and accounting. Please note that accounting is a subject that graduates took at least 3 years to learn the tools, and plenty of years to hone their accounting skills and experience.

The Starting Block of Bookkeeping

Bookkeeping relies primarily on ONE principle rule: The Debit and Credit Rule. For every amount debited, there is an equal amount to be credited into the books of the Company (similar to Newton’s 3rd Law of Motion “To every action there is always opposed an equal reaction”). The rationale is very simple. Think about it:

When you make a sale and receive cash, you Debit your Bank Account and Credit your Sales Account.

When you make a sale on credit terms, you Debit your Sales Receivable and Credit your Sales Account.

When you pay for a new laptop you purchase, you Debit Fixed Asset Account and Credit your Bank Account.

When you make a loan to the Company, you debit the Company Bank Account and Credit a Loan Account.

And the list goes on and on for every kind of accounting transaction known to us…

Express Debit Credit Rule Convention

| ACTIVITY | DEBIT | CREDIT |

| MAKING A CASH SALE | Cash at Bank or Cash on Hand | Revenue |

| MAKING A CREDIT SALE | Account Receivables | Revenue |

| PURCHASE A FIXED ASSET | Fixed Asset | Cash at Bank or Cash on Hand |

| INCURRING PAID EXPENSES | Specific Expense Line | Cash at Bank or Cash on Hand |

| INCURRING UNPAID EXPENSES | Specific Expense Line | Account Payable |

| ACCOUNTING FOR DEPRECIATION | Depreciation Expense | Accumulated Depreciation |

| TAKING UP A BUSINESS LOAN | Cash at Bank | Bank Loan |

| REPAYING INSTALMENTS FOR THE LOAN | Bank Loan Interest Expense | Cash at Bank or Cash on Hand |

So you will be asking: “How do you know whether I should debit or credit a particular account for a business transaction?”

Before you answer this question, you must appreciate that a typical set of account is divided into a 4 major sections:

| Account Type | Simple Explanation | Debit Credit Convention |

| Assets | Include assets to the company like Cash at Bank, Cash on Hand, Net Book Value of Fixed Assets, Trade and Other Receivables, and Company Loans given to others | Debit to INCREASE Asset Amount Credit to DECREASE Asset Amount |

| Liabilities | Include liabilities of the company like Trade and Other Payables, and Loans taken up by the Company | Credit to INCREASE Liability Amount Debit to DECREASE Liability Amount |

| Share Equity | Includes the Share Capital of the Company together with past and current year earnings surpluses or deficits accumulated to date | Credit to INCREASE Equity Amount Debit to DECREASE Equity Amount |

| Profit and Loss | Includes all the revenue, cost of sales/service, operating expenses, finance costs, depreciation and tax expenses incurred in a particular stretch of period. | Credit to INCREASE Sales Amount Debit to DECREASE Sales AmountDebit to INCREASE Expense Amount Credit to DECREASE Expense Amount |

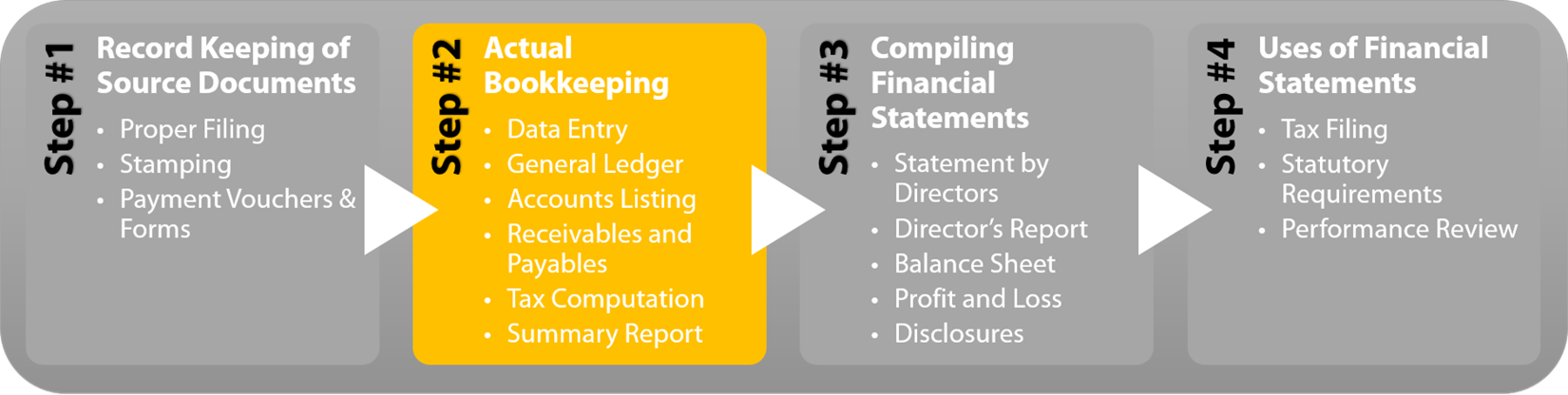

The Data Entry Process

The data entry process is fairly straight forward for experienced bookkeepers as the information to be captured in your entries can be mostly found in the source documents if the preparatory work for the source documents are done up properly (indicating whether transaction is paid/received with the date written on the invoices and receipts, etc.)

If you are using an off the shelf accounting system, the entry panels are typically divided into four main entry panel which typically will include Sales, Expenditures, Making Payments, Receiving Money.

You will usually need to assign a particular transaction to a specific account line in your Chart of Accounts, a table that lists out all the available account types in your accounting file.

For example, when you make an entry in the Sales panel, it will automatically credit the Revenue Account (or you can select specific revenue account) and debit the Accounts Receivable Account. Do keep a look out for any fields on this panel that indicates if the money have been received. If the software does not come with this feature, you will need to go the Receiving Money Panel to record that this specific revenue amount has been received.

If you are managing accounts in a spreadsheet, you will need to ensure that all transactions have a proper record of whether the amount has been paid or received, transaction reference (cheque number, Cash etc.) as well as the date of transaction. A simple guide for your spreadsheet format will be as follows:

| Date of Invoice | Invoice Ref | Description | Account Name | Amount (S$) | Transaction Ref | Transaction Date | Balance Outstanding | Remarks |

| 1 Jan 2014 | INV-10001 | 100 x Shoes | Revenue | $1,000 | DBS 123435 | 1 Jan 2014 | $0.00 | Fully Paid |

The General Ledger

The General Ledger is a detailed listing of all your accounting records which have been input into the accounting system, categorized by the each line of accounts. If you are using a software, this is a standard report feature that you can generate. If you are on spreadsheets, some form of sorting and re-organization needs to be done to retrieve this form of report.

A general ledger will allow the report user to review the transactions within each specific account to ensure that accounts are classified correctly and recorded accurately.

Account Listing

The most important account listing will be your sales listing, payroll listing, fixed asset listing and supplier listing. Account listing will serve as useful information for users if they would like to review only a specific account instead of the whole set of detailed listing.

Receivables and Payables

The Receivable and Payable reports are extremely crucial for companies where cashflow management is of significant importance. These 2 reports will allow users to see which customer is owing the company money and which suppliers are due for payment from the company. These reports can be further classified by vendor names if the source documents are properly management and method and detail of data entry is kept consistent.

Summary Report

A summary report or management accounts for a defined period can be retrieved from an accounting system which serves as a top level performance report card for the company. You will be able to see the total assets held by the company, how much debt is the company owing and the profit and expense quantum for the particular period. You can take a look at a graphical illustration of how your transactions are summarized into your Company Balance Sheet and Profit and Loss Statement HERE.

Tax Computation

When performing tax computation for your Company, you will need the details of the General Ledger as well as the management accounts to correctly compute your company taxes. Please be aware that tax rules deviate from accounting rules, and tax treatment for specific expense lines may require additional computation work. On top of that, certain expenses are also specifically flagged as non-deductible expenses when submitting your tax forms. You may read up about the basics of company taxes in our Tax Resource section.

Compiling Financial Statements

The compilation process will commence only when the bookkeeping procedures have been finalized. Read on in our next section, “The Financial Statements”, to learn more about financial statements and its compilation methods.